About Us

Block Funds is a leading real estate private equity firm that specializes in the creation and preservation of generational wealth and passive income for our investors through commercial real estate partnership opportunities. Block Funds’ online Investor Portal delivers a transparent and efficient way to make allocations and monitor interests in institutional quality commercial properties from virtually anywhere. Partnership reduces required investment amounts, unlocking ownership opportunities that were once unattainable for many private investors. Accredited investors seeking current income, capital preservation, and appreciation can earn high, stable cash yields and competitive risk-adjusted returns. Commercial real estate investments exhibit lower correlation to other asset classes, lower volatility as compared to public markets and provide for passive income streams by way of distributions. Diversification is achieved through property type (office, multi-family, industrial, retail, medical office), risk level and geographical location across the United States. Our investors are provided access to the same acquisition, development, management, and leasing experience as institutional investors. Accredited investors should visit www.BlockFunds.com to register and view our current investment offerings.

Block Funds is a leading real estate private equity firm that specializes in the creation and preservation of generational wealth and passive income for our investors through commercial real estate partnership opportunities. Block Funds’ online Investor Portal delivers a transparent and efficient way to make allocations and monitor interests in institutional quality commercial properties from virtually anywhere. Partnership reduces required investment amounts, unlocking ownership opportunities that were once unattainable for many private investors. Accredited investors seeking current income, capital preservation, and appreciation can earn high, stable cash yields and competitive risk-adjusted returns. Commercial real estate investments exhibit lower correlation to other asset classes, lower volatility as compared to public markets and provide for passive income streams by way of distributions. Diversification is achieved through property type (office, multi-family, industrial, retail, medical office), risk level and geographical location across the United States. Our investors are provided access to the same acquisition, development, management, and leasing experience as institutional investors. Accredited investors should visit www.BlockFunds.com to register and view our current investment offerings.

Allen Block Circa 1969

Block Funds was founded in July 2004, but the roots of this premier private equity fund sponsor go back over seven decades to 1940 when Allen J. Block began his career in real estate. In the 1970s, Allen’s sons, Stephen, Kenneth and Michael, all joined their father in the family business, which grew into a regional, full-service commercial real estate brokerage company. In 2009 the brothers established Block Real Estate Services, LLC (BRES) in order to further the company’s mission and to carry on their father’s legacy.

Today BRES remains a successful, independent, family-run business that values accountability, long-term commitment and the relentless pursuit of excellence. BRES recently completed a record fiscal year with total sales and leasing transactions in excess of $1.3 billion. BRES' management portfolio reached 46 million of commercial square feet and over 9,200 multifamily units. Block Construction Services, a subsidiary of BRES, completed tenant improvements and development projects in 2025 exceeding $89 million. BRES completed over $221 million in investment sales and with Block Funds, raised over $79 million in equity funds for syndication of new acquisitions and development projects.

Bolstered by BRES' core values and solid foundation of commercial real estate expertise, Block Funds is writing its own distinct success story. That story began in 2004 as demand for investment real estate surged. In response to this rising demand, the Block family leveraged its decades of commercial real estate knowledge to create Block Funds. The idea was to partner with individual investors to build a portfolio of institutional-quality office, industrial and retail commercial real estate.

The emerging success story that is Block Funds is a testament to its roots in BRES' enduring tradition of commitment to core values, strong client relationships, and progressive but responsible investments.

At Block Funds, our investment philosophy is driven by adherence to market fundamentals. The Block Funds team is dedicated to sound market research, detail-oriented asset management, and relationship-driven real estate. Adherence to these and other fundamentals helps our professionals to find and acquire compelling commercial real estate investments in our target markets and to manage those investments in a manner that mitigates risk while maximizing returns for our investors.

Our dedication to steady, disciplined market research helps us find institutional quality commercial real estate investments with unrealized value at the right time. At Block Funds an acquisitions professional is assigned to each target market. This enables our acquisitions professionals to develop an in-depth understanding of opportunities presented by each target market and to create an investment strategy to take advantage of pricing and operating inefficiencies within each target market and among available property types. We pride ourselves on being the most knowledgeable, responsive real estate team in the market.

Block Funds professionals are also experts at providing world-class asset management. We do our homework by learning everything there is to know about the properties we acquire and ignore no detail in the strategic management of these assets for our investors. Active market research and active asset management are fundamental to building wealth for our investors and we take both very seriously. At Block Funds, we build for our investors a diversified portfolio that weathers changing markets and provides stable returns with low correlation to the performance of the stock and bond markets.

Our dedication to relationship-driven real estate perhaps says the most about who we are. Block Funds professionals pursue and maintain long-term relationships with key people in commercial real estate like brokers, sellers, developers, and financial partners. Building and nurturing these relationships helps us stay on top of changing trends in our target markets. More importantly, though, these relationships help us find unlisted, off-market acquisition opportunities at discounted prices.

The commitment by Block Funds to relationship driven real estate also extends to our clients. We value the relationships with our investors who rely on us as faithful stewards of their wealth. Our clients trust us to provide strong, stable returns on their investments and we deliver. In a world economic climate beset by increased volatility, the strength of Block Funds as a stable steward of our client's wealth remains an essential component of who we are.

By focusing on real estate fundamentals, Block Funds invests in properties that meet our objectives of capital preservation, current income and long-term capital appreciation. Our investors earn a return on their investment through monthly income distributions, equity achieved through loan principal paydown, and through realizing appreciation in the value of fund properties at the sale of such properties. Block Funds long-term, fundamental value-based approach to investing delivers superior risk-adjusted returns across changing real estate market cycles and shifts in the global economy.

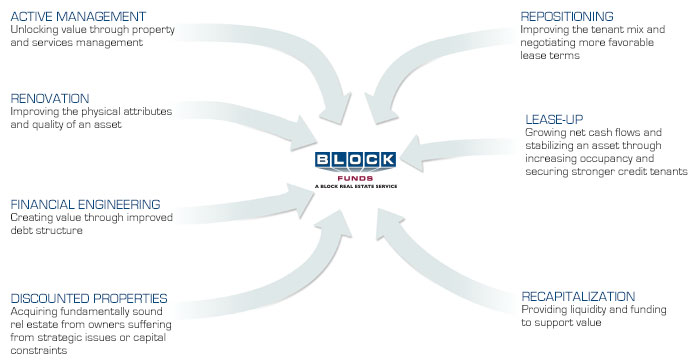

Block Funds team of professionals has the experience and expertise to locate excellent investment opportunities with attractive stabilized cash flows and outstanding potential at a substantial discount to replacement value, in all types of market cycles. Block Funds establishes a business plan for each asset, identifying strategies to optimize income and positioning each asset to maximize investor return at exit. By taking advantage of pricing and operating inefficiencies inherent in commercial real estate, Block Funds creates value through leveraging our experience and expertise.

Kansas City Business Journal

- #1 – Largest Commercial Real Estate Developers (Ranked by sq ft of commercial space developed or redeveloped in the KC area in the past 5 years 2019-24)

- #2 – Commercial Real Estate Firms (Ranked by $ volume of sales and lease transactions in the KC area in 2024)

- #1 – Most-Active Commercial Real Estate Firms (Ranked by # of sales and lease transactions in the KC area in 2024)

- #1 – Commercial Property Managers List (Ranked by leasable sq ft under management in the KC area)

- #5 Top Area Office Parks and Complexes (Pine Ridge Business Park — 1.78 million square feet)

- #7 Top Area Multitenant Industrial Facility (Lenexa Logistics Centre — 4.1 million square feet)

- #9 Top Area Office Parks and Complexes (CityPlace Corporate Centre — 430,916 square feet)

- #17 Top Area Multitenant Industrial Facility (Riverside Industrial and Distribution Center — 2.04 million square feet)

- #22 Top Area Multitenant Industrial Facility (Pine Ridge Business Park — 1.78 million square feet)

- #29 Top Area Multitenant Office Building (46 Penn Centre — 229, 014 total leasable square feet)

St. Louis Business Journal

- #19 Largest commercial real estate firm, based on number of local active licensed agents (Block Hawley)

- #23 Largest commercial real estate firm, based on number of total local staff (Block Hawley)

National Real Estate Investor

- Ranked 23rd for total office space developed or under construction of 600,000 square feet

Commercial Property Executive - National Ranking

- Ranked 13th top national property manager

- Ranked 28th top national commercial development firm

- Ranked 39th top national multifamily owners

Midwest Real Estate News

- Ranked 2nd in top owners in the Midwest

- Ranked 9th in top property management in the Midwest

- Ranked 6th in top developers in the Midwest

- Ranked 13th in top brokers in the Midwest

Ingram's

- #1 Top area commercial real estate company for square footage managed, sold, and leased

- #2Top area commercial real estate company for gross sales

- Best Commercial Real-Estate Firm - Bronze Award

CoStar Group, Inc.

- #2 Top area leasing firms

- #3 Top area sales firms

- Power Broker Award Winner

Award Winning Developments

- 2024 — CityPlace Corporate Centre IV, Overland Park, Kansas - Capstone Award Winner, Kansas City Business Journal

- 2024 — 1520 Grand, Kansas City, Missouri - Costar Impact Award

- 2023 — The Residences at Galleria Capstone Award Winner, Kansas City Business Journal

- 2022 — Villas at 44 Washington/44 Washington Capstone Award Winner, Kansas City Business Journal

- 2021 — 46 Penn Centre, Kansas City, Missouri - Capstone Award Winner, Kansas City Business Journal

- 2019 — 531 Grand, Kansas City, Missouri — Capstone Award Winner, Kansas City Business Journal

- 2019 - The Grand, Kansas City, Missouri - Best Adaptive Re-Use, Excellent Award - Historic Kansas City, Kansas City Business Journal

- 2019 - The Grand, Kansas City, Missouri - Capstone Award Winner, Kansas City Business Journal

- 2018 - The Equitable, Des Moines, Iowa - William J. Wagner Award - State Historic Preservation Office

- 2018 - Lenexa Logistics Centre Building 7, Lenexa, Kansas - Capstone Award Winner - Kansas City Business Journal

- 2017 - The Royale at CityPlace, Overland Park, Kansas - Capstone Award Winner - Kansas City Business Journal

- 2017 - Lenexa Logistics Centre North Building 1, Lenexa, Kansas - Capstone Award Winner - Kansas City Business Journal

- 2015 - Lenexa Logistics Centre Building 4, Lenexa, Kansas - Capstone Award Winner - Kansas City Business Journal

- 2014 - Nall Corporate Centre I, Overland Park, Kansas - Capstone Award Winner - Kansas City Business Journal

In addition, BRES professionals have been playing an active role in professional organizations on a local, regional, and national level. In addition to professional and industry-related organizations, BRES staff and professionals are active in all parts of the community, both professionally and personally. BRES employees contribute time and resources to numerous chambers of commerce, economic development, local government, social services, community involvement, arts and culture, health, education and youth enrichment organizations. The BRES team has been providing leadership in the real estate industry for more than 70 years. Below is a selection of industry-related organizations and business affiliations in which BRES is active:

- American Concrete Institute (ACI)

- Building Owners and Managers Association (BOMA)

- Certified Commercial Investment Member (CCIM)

- Design Build Institute of America (DBIA)

- Institute of Real Estate Management (IREM)

- International Council of Shopping Centers (ICSC)

- Kansas Association of REALTORS®

- Kansas City Area Development Council (KCADC)

- Kansas City Commercial Real Estate Women (KC Crew)

- Kansas City Regional Association of REALTORS® (KCRAR)

- KC SmartPort

- Missouri Association of REALTORS®

- Missouri Growth Association (MGA)

- NAIOP Commercial Real Estate Development Association (NAIOP)

- National Association of REALTORS® (NAR)

- Society of Industrial and Office REALTORS® (SIOR)

- Urban Land Institute (ULI)

- US Green Building Council (USGBC)

BRES emphasizes continuing development through professional organizations and continuing education. BRES and its professionals hold the following designations:

- Accredited Management Organization (AMO)

The leadership team of Block Funds has over 200 combined years of experience in real estate and have been involved in investment transactions totaling over $5.3 billion. We have developed an expertise in sourcing, structuring, developing and managing superior commercial real estate investments.

As part of a fully integrated commercial real estate and private equity institution, Block Funds investment professionals are knowledgeable in all aspects of commercial real estate including development, construction management, commercial brokerage, asset management, investments, corporate real estate services and strategic support. Our multi-disciplinary experience and expertise allows Block Funds to identify and unlock value in commercial real estate that would not otherwise be recognized.

Principals

KENNETH G. BLOCK, SIOR, CCIM

Managing Principal

Kenneth G. Block is the managing principal of Block Real Estate Services, LLC. He entered the real estate field in 1975 and specializes in investment sales and development of industrial, office, and business park properties. To date, he has been involved in the development of over 340 buildings with a total value in excess of $4.8 billion. Over his career, he has been involved in more than $5.3 billion of property sales and dispositions in all asset classes.

Ken is thoroughly knowledgeable in all aspects of real estate brokerage, development, construction, financing, syndication, leasing and marketing. Ken is an active industrial member of SIOR and a member of CCIM. He currently serves on the editorial advisory board of Midwest Real Estate News.

Leadership

AARON M. MESMER, CCIM

Chief Investment Officer

816.412.5858 | amesmer@blockllc.com

Property Specialty: Multifamily and Industrial

Aaron Mesmer joined Block Real Estate Services, LLC (BRES) in 2005 as an investment specialist focused on the sale of commercial and multifamily properties. Over the past 19 years, his role has evolved to include the acquisition and development of office, medical, industrial, retail and multifamily properties. In 2024, Aaron was named Chief Investment Officer for the Block Funds, tasked with overseeing fundraising and capital allocation to new investment opportunities.

Since joining BRES, Aaron has been involved in hundreds of transactions totaling more than $3 billion. This includes the acquisition, sale, leasing or development of more than 2.0 million square feet of office, 1.3 million square feet of medical, 8.5 million square feet of industrial and 800,000 square feet of retail space as well as more than 10,000 multifamily units and 2,000 acres of land.

GRANT O. REVES, CCIM

Director of Acquisitions

816.412.5879 | greves@blockllc.com

Property Specialty: Multifamily and Industrial

Grant Reves joined Block Real Estate Services, LLC in February 2007 as an investment real estate specialist focused on multifamily acquisitions. As a member of Block’s Investment Services Group, Grant’s responsibilities on behalf of clients include the review and analysis of potential acquisitions, due diligence, transaction valuation and execution, and detailed financial modeling. Since 2002, Grant has been involved in transactions totaling more than $2 billion.

JASON CHARCUT

President, Block Multifamily Group

816.878.6317 | jcharcut@blockmultifamily.com

Jason Charcut joined Block Real Estate Services in 2018 as the Asset Manager of Multifamily Investments. He is responsible for the execution of the strategic business plans for each owned property with a focus of achieving cash flow yields, occupancy, and the overall performance of the assets. Jason possesses a wide knowledge base of management and operational experience in student, rehab, mid-rise, high-rise, garden and townhome communities. He has developed and executed numerous efficiency programs to improve profitability and accountability within the organizations he has worked, which has led to a consistent track record of increasing the value of assets under his leadership. Jason is a graduate of The University of Kansas with a Bachelor of Science degree in Strategic Communications. He has also received professional designations through the National Apartment Association including Certified Apartment Manager (CAM), and Certified Apartment Property Supervisor (CAPS).

SCOTT M. CORDES

Executive Vice President / COO

816.932.5594 | scordes@blockllc.com

Scott M. Cordes is Block Real Estate Services, LLC (BRES) Executive Vice President and Chief Operating Officer. He rejoined BRES in 2020 having held an industrial brokerage position with the firm from 2004-2013. His responsibilities include development, implementation, and oversight of corporate strategy for BRES Kansas City, Block Hawley (BRES St. Louis affiliate), Block Multifamily Group, Block Maintenance Solutions, and other company subsidiaries. In addition to his corporate responsibilities, Scott oversees a team of over 20 directors/managers and support staff responsible for delivery of asset and property management services for a portfolio exceeding 45 million square feet of office, industrial, medical, multifamily and retail space across the country. He also provides leadership to BRES’ operating departments which include marketing, administrative, investment, brokerage, and insurance services.

KEN STEEN

Executive Vice President, Chief Financial Officer

816.932.5573 | ksteen@blockllc.com

Ken Steen is an experienced financial professional with a diverse background in real estate and investment accounting. He holds a Bachelor of Science in Finance from Northern Illinois University. Before joining Block, Ken spent 17 years at the largest custodian bank in the U.S., where he served as Vice President of Investment Accounting. He began with Block Real Estate Services in September 2010, where he initially supported the financial accounting for several portfolios.

In 2012, Ken was promoted to Accounting Manager, where he played a pivotal role in supporting the acquisitions and dispositions of various property transactions. After a brief tenure with a boutique developer in Kansas City in 2016, Ken returned to Block Real Estate Services in 2018 as Controller. Ken. He is currently working toward his CCIM (Certified Commercial Investment Member) accreditation. In 2024, Ken was promoted to Chief Financial Officer.

Investor Relations

ERIN EYTCHESON

Vice President, Investor Relations

816.410.9589 | eeytcheson@blockllc.com

Erin Eytcheson is Vice President of Investor Relations at Block Funds, where she engages directly with accredited investors and oversees the firm’s investor portal to support seamless online commercial real estate investments. Since joining Block Funds in 2007, she has helped raise more than $1.7 billion in investor equity, drawing on 25+ years of executive-level experience and 15 years specializing in private equity placement.

Erin manages all phases of the investment lifecycle, including onboarding, offering coordination, SEC compliance, and ongoing relationship management, and is known for her strategic communication and process-driven approach. Prior to Block Funds, she worked in continuing education at Kansas State University, where she earned her Bachelor of Science degree in Agriculture. Her professionalism and dedication help ensure investors feel informed, confident, and supported throughout their investment journey.